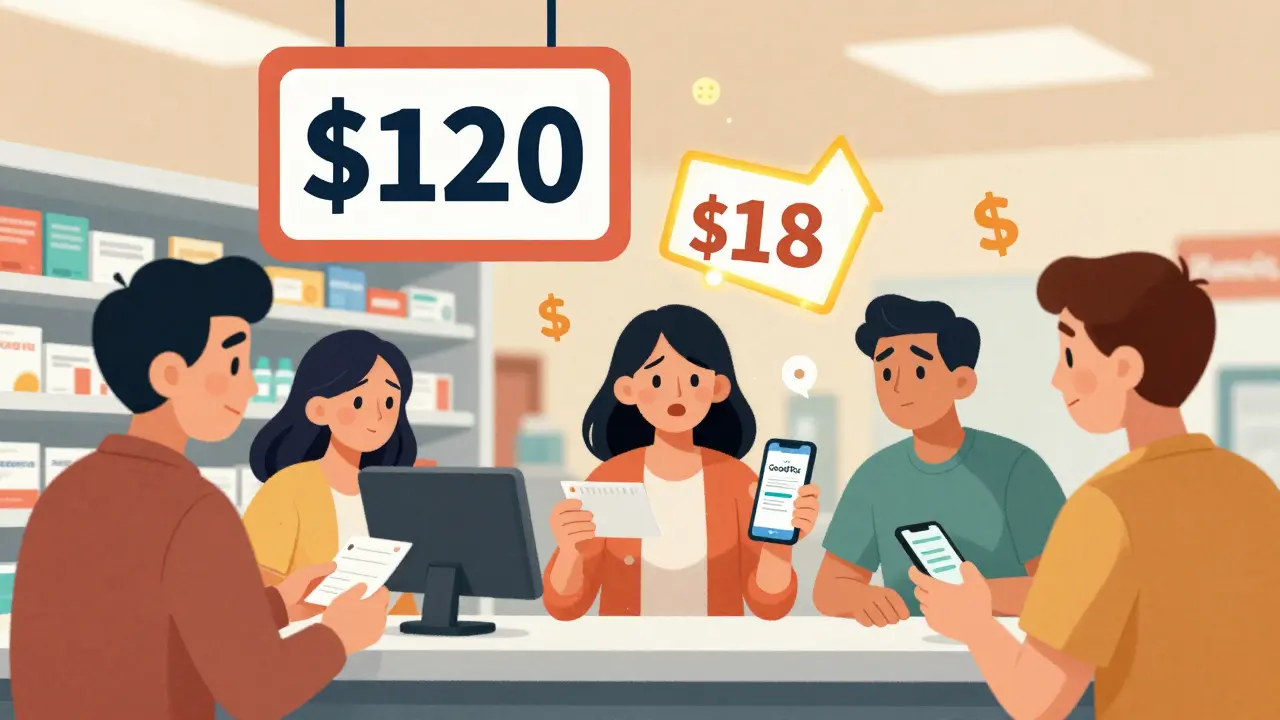

When you walk into the pharmacy with a prescription in hand, the price tag can feel like a punch to the gut. A 30-day supply of your medication costs $120? Your insurance says you owe $40? Then you pull out a coupon from GoodRx and it drops to $15. It feels like magic. But is it really helping - or just shifting the cost elsewhere? The truth is, prescription discount programs and coupons work - but not the way most people think.

How These Programs Actually Work

There are three main types of prescription discount tools out there, and each plays by different rules.Manufacturer coupons are issued directly by drug companies. They’re often found online or in mailers, and they reduce your copay at the pharmacy. But here’s the catch: they only work on brand-name drugs. And they don’t lower the list price. They just make you pay less out of pocket - while the insurance system and taxpayers still cover the rest.

Third-party discount cards - like GoodRx, Blink Health, and SingleCare - are the most popular. These companies negotiate prices directly with pharmacies. You don’t need insurance. You just show the card or app at the counter. They work best on generics. For example, a 90-day supply of metformin might cost $52.80 at full price, but with GoodRx, it drops to $18.60. That’s a 65% cut. For some people, it’s the difference between taking their meds and skipping them.

Prescription Assistance Programs (PAPs) are run by nonprofits or clinics. These give free or deeply discounted drugs to people who qualify based on income. One Tennessee free clinic helped 61 patients over 13 months, saving them a total of $222,563. That’s an average of $3,649 per person. But getting into these programs isn’t easy. You need paperwork, proof of income, and time to fill out forms. It’s not a quick fix.

When They Work Best

If you’re taking a generic drug - especially one like lisinopril, metformin, or atorvastatin - a discount card like GoodRx almost always beats your insurance copay. In fact, a 2022 study in Circulation: Cardiovascular Quality and Outcomes found that discount cards cut generic drug costs by an average of 65%. That’s not a rumor. That’s data.

For people without insurance, this is a lifeline. Blue Cross Blue Shield found that 54% of members who stopped filling prescriptions because of cost went back to taking their meds after using a discount card. The average savings? $18.75 per prescription. That’s money that can go toward groceries, rent, or gas.

Seniors on Medicare Part D are another big group who benefit. The AARP found that more than half of Medicare users could save at least 20% on their prescriptions by comparing card prices to their plan’s copay. Nearly half saved more than $5 per prescription. That adds up fast if you take five meds a month.

When They Don’t Work - Or Even Hurt

Here’s the dark side: prescription discount programs can make things worse.

Brand-name drugs? Don’t expect much. The same Circulation study showed that coupons for brand-name heart failure drugs only lowered prices by 6.8% to 11.7%. If your drug costs $1,300, you’re still paying over $1,200 even with a coupon. That’s not saving money. That’s just a tiny discount on a massive bill.

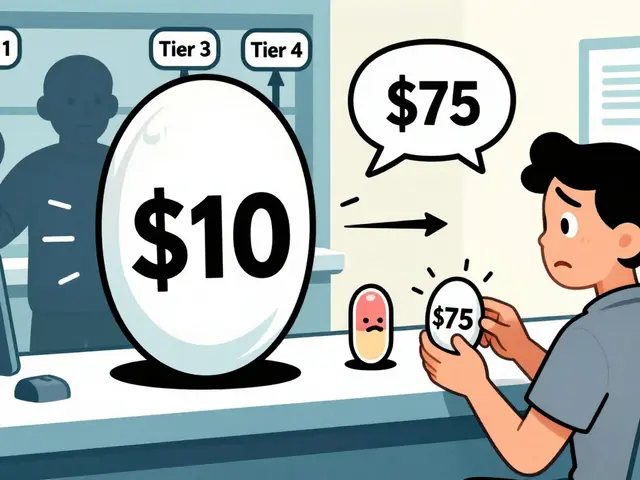

Worse, manufacturer coupons can push you toward more expensive drugs. A 2024 JAMA Network Open study found that when patients used coupons for brand-name drugs, they were 60% more likely to stick with them - even when cheaper, equally effective generics were available. This isn’t just about personal choice. It’s about the system. The Congressional Budget Office estimates these coupons add $2.7 billion a year to Medicare Part D spending. That’s because insurers and government programs still pay the full list price. You get a break. The system pays the rest.

And then there’s the confusion. Medicare Part D rules say you can’t use manufacturer coupons if your drug is covered under your plan - unless you get special approval. Many people don’t know this. They show up at the pharmacy with a coupon, get turned away, and think the system is broken. It’s not. It’s just complicated.

Real People, Real Savings (and Real Frustration)

Reddit user u/MedSaver2023 saved $47.83 on a 90-day supply of metformin using GoodRx - less than the cost of a coffee. That’s a win.

But u/ChronicPainPatient used a coupon for Lyrica - a brand-name nerve pain drug - and saved just $1.20. That’s not saving. That’s a drop in the bucket.

On Trustpilot, GoodRx has a 4.3/5 rating. People love the app. They love the savings on generics. But 37% of negative reviews complain about inconsistent pricing between pharmacies. One pharmacy says $12. Another says $24. You have to call five places before you find the best deal. That’s time. And time is money.

Pharmacists often don’t know how to process these cards. One user on Consumer Affairs said they waited 20 minutes while the pharmacist called the manufacturer for clarification. That’s not a customer service issue. That’s a system design flaw.

What You Should Do

Here’s how to actually use these tools without getting fooled:

- Always compare your insurance copay with the GoodRx price before you fill the script. Use the app. It’s free.

- For generics, the card almost always wins. Use it.

- For brand-name drugs, check if a generic is available. Ask your doctor. It’s not a betrayal - it’s smart care.

- Never use a manufacturer coupon if you’re on Medicare Part D unless your pharmacist confirms it’s allowed. Otherwise, you’ll get stuck paying full price later.

- If you’re uninsured or on a tight budget, look up PAPs through NeedyMeds.org. It takes time, but it can give you free drugs.

- Don’t assume your insurance knows best. Sometimes, paying cash with a coupon is cheaper than using your coverage.

The Bigger Picture

These programs exist because drug prices are broken. They’re not a solution. They’re a band-aid on a wound that needs surgery.

The 2024 Inflation Reduction Act is starting to change things. Starting in 2025, Medicare beneficiaries won’t pay more than $2,000 a year for drugs. That will cut demand for discount cards among seniors. But for the 30 million Americans without insurance? They’ll still need these tools.

Some experts, like Dr. Stacie Dusetzina from Vanderbilt, say the future lies in integrating discounts into insurance plans - not working around them. That means insurers negotiating better prices upfront, not patients hunting for coupons like treasure hunters.

For now? Use them. But use them wisely. Know your drug. Know your plan. Know your price. Because in this system, the person who saves the most isn’t the one with the coupon - it’s the one who asks the right questions.

12 Comments

I used GoodRx for my metformin last month and saved like $40. I didn’t even know to check it before. My pharmacist didn’t mention it either. Just showed up with my script and went ‘uhhh’ when I pulled out the coupon. Now I check every time. It’s not magic, but it’s the closest thing we got.

Man, these discount cards are like finding a $20 bill in your jeans pocket-except the jeans are the healthcare system and the pocket is full of holes. I mean, we’re all just trying not to go broke taking pills that cost more than my car payment. And don’t even get me started on how pharmacies treat these cards like they’re cursed. One time I had to argue with a tech who thought ‘GoodRx’ was a new brand of cough syrup.

Oh sweet mercy, another person who thinks coupons are saving us. Let’s be real-these programs exist because Big Pharma won’t let prices drop. They’re not helping you. They’re helping the system avoid accountability. I’ve seen people use coupons for brand-name drugs and then get mad when their Medicare Part D bill spikes next year. It’s like using duct tape on a leaking dam and calling it a fix.

In India, we don’t even have this luxury. My cousin in Delhi pays $80 for a 30-day supply of insulin-no coupons, no discounts, just raw price. So when I see Americans arguing over $15 vs $40, I feel a little… detached. Not jealous. Just… confused. How did we get so used to fighting over crumbs when the whole cake is stolen?

People who use GoodRx are just enabling the system. You think you’re saving money? Nah. You’re just making the drug companies richer because they know you’ll pay full price later. And don’t get me started on how you’re all too lazy to ask for generics. If you’re taking brand-name statins, you’re either rich or dumb. Probably both.

The system is broken and everyone’s just patching it with duct tape and prayers. I don’t care if you save $15 or $150. The fact that you need a coupon just to afford your blood pressure med means we’ve failed as a society. And yes I know Medicare won’t let you use coupons but that’s because they’re scared of the real cost. Stop acting like this is a personal win. It’s a national shame.

I’ve been using discount cards for five years now. I take like six meds, all generics, and between GoodRx and SingleCare, I’ve saved over $3,000. I know it sounds crazy but it’s real. I used to skip doses because I couldn’t afford it. Now I take them like clockwork. I don’t care if it’s a band-aid or a surgery-I’m alive. And I’ve got receipts. Literally. I keep every receipt. My wife thinks I’m weird but I tell her, ‘Honey, this is how we eat this month.’

The key is always comparing your insurance copay with the cash price. I do it every time. Sometimes insurance wins. Sometimes the card wins. But if you don’t check you’re just guessing. And guessing when your life depends on it? That’s not smart. Also pharmacists need training. Most don’t know how to process these cards. It’s not their fault. The system’s just a mess.

You people are so entitled. You think because you live in America you deserve cheap drugs? In my country, people walk 10km to get medicine. You complain about $20? You don’t even know what real suffering is. Stop using coupons. Just be grateful you have a pharmacy at all. And if you can’t afford your meds? Maybe you shouldn’t have had that third latte this week.

Life is a journey 🌱 and sometimes the best thing you can do is take a deep breath and find the path that works for you. I used to think coupons were ‘gaming the system’… until I saw my mom cry because she couldn’t afford her diabetes meds. Now I use them daily. It’s not about right or wrong. It’s about survival. And if a $15 script means someone gets to see their grandkid’s birthday? That’s not a hack. That’s love. 💖

I just want to say… thank you. Seriously. This post made me feel less alone. I’ve been using PAPs for my kidney meds and it’s been a nightmare of paperwork. But I got through it. And now I’m stable. And I’m alive. And I’m not ashamed to say I cried when I got the approval letter. You’re not just talking about drugs. You’re talking about dignity. And that matters.

I just used a coupon for Lyrica and saved $1.20. I felt like an idiot.